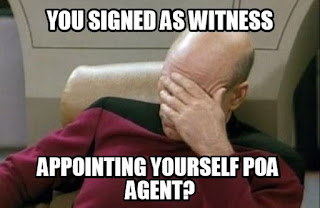

Another Cautionary Tale for Power of Attorney Agents and Self-dealing

The Illinois Appellate Court 4th District case of Collins v. Noltensmeier provides an example of why power attorney agents need to tread very carefully when giving gifts to themselves. After the principal (Billy) passed away, the case arose as a dispute between Billy's brother and niece (plaintiffs) and his long-term girlfriend/partner Patricia who also acted as his caretaker. Billy signed a will and power of attorney for property (using the statutory short form ) about a week before he passed away, naming Patricia as his POA agent, executor and sole beneficiary in his will. After Billy died and Defendant filed his will with the court, plaintiffs filed a will contest and a separate case against defendant for breach of fiduciary duty and wrongful conversion of Billy's IRA. Apparently Patricia acting as POA agent for Billy had changed the beneficiary of his IRA, to herself. In court, Patricia defended herself by citing the wording of the Illinois statutory POA form, whi...